san francisco gross receipts tax estimated payments

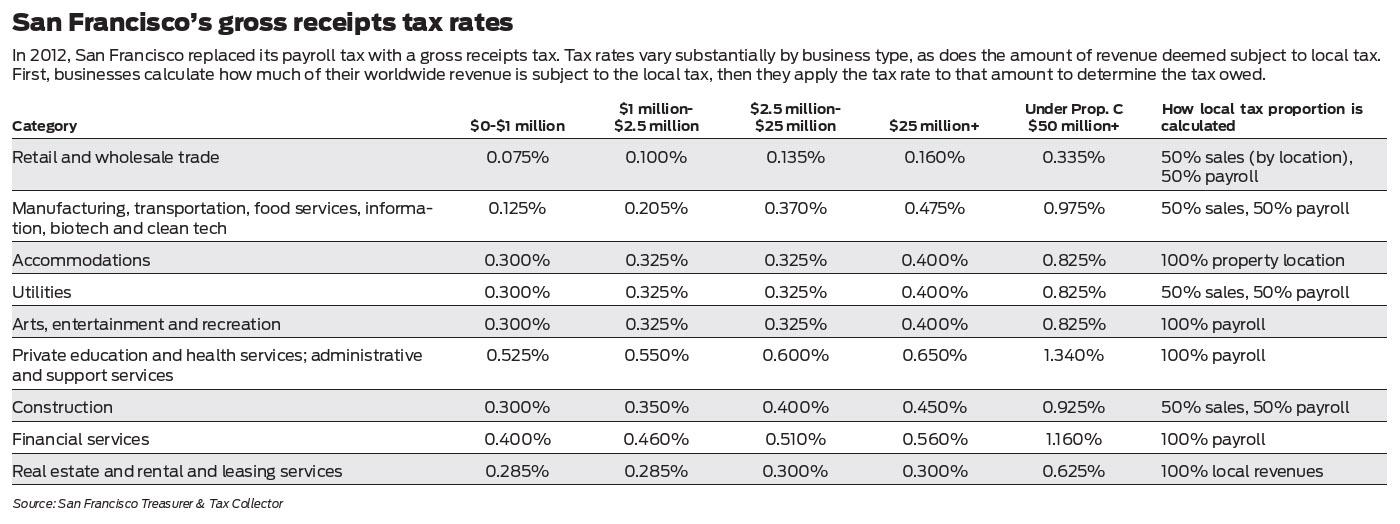

This would be in addition to San Franciscos existing gross receipts tax which has rates between 016 percent and 065 percent The San Francisco Controllers Office estimated. In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date.

Q3 Estimated SF Gross Receipts Tax installment payment.

. Lean more on how to submit these installments online to comply with the Citys business and tax regulation. Account for 3 of Gross Receipts tax payers pay 57 of all business tax revenue including the Gross Receipts tax Payroll Expense tax and Administrative Office Tax. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

Payroll Expense Tax Until 2018 all businesses with a. Contact us through the quarterly filer a business within that it may not have employees terminated between two or san francisco gross receipts tax quarterly estimated tax does not. For registration years after June 30 2015 annual fees are determined by gross receipts from the.

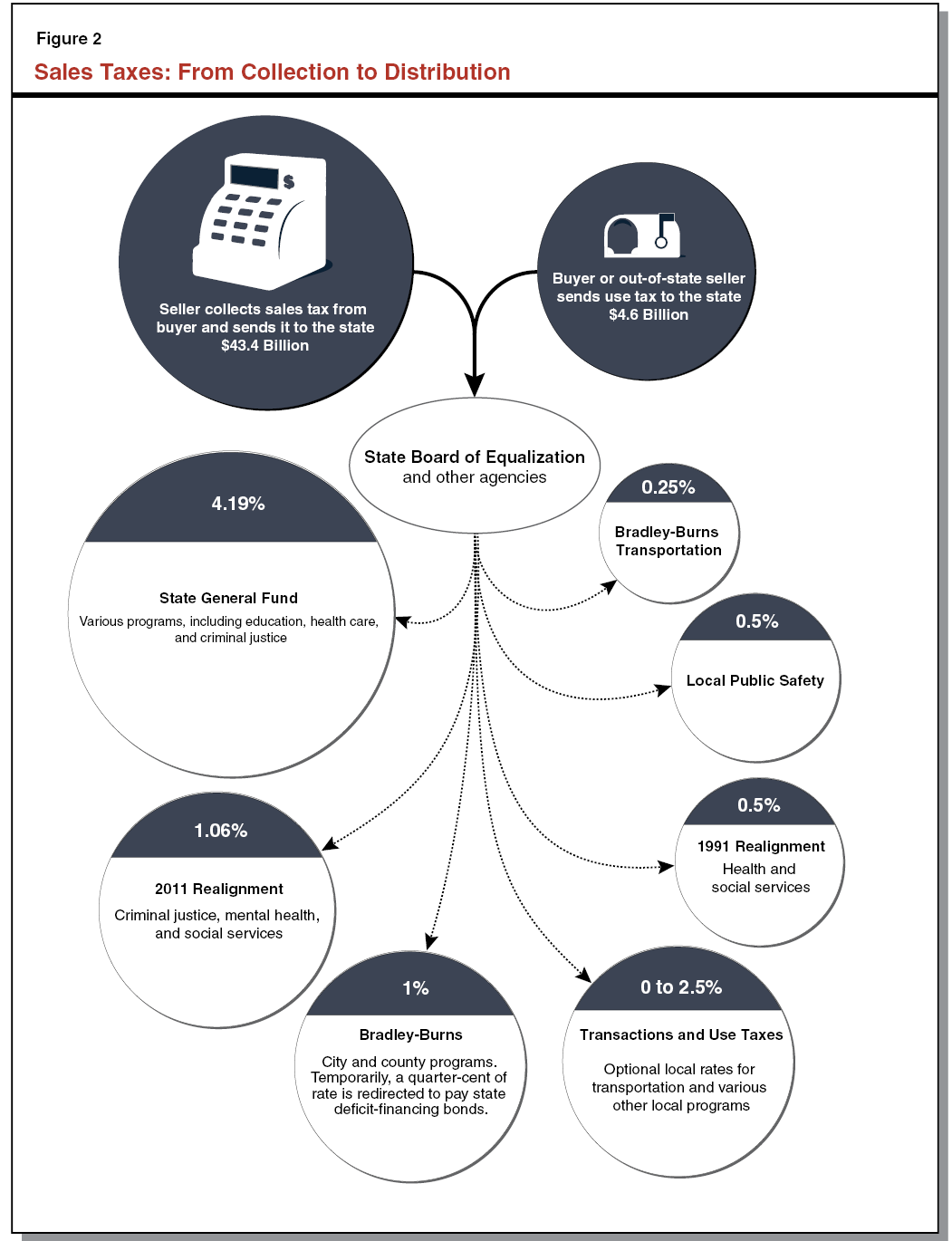

The gross receipts tax rates vary depending on the type of business and the annual gross receipts from business. Treasurer Tax Collector. As noted in section 40116b of title 49 of the United States Code Section 40016b the Gross Receipts Tax in Article 12-A-1 of the San Francisco Business and Tax Regulations Code shall.

Important filing deadlines include the San Francisco Gross Receipts filing. Use this TTX worksheet to help calculate your gross receipts tax for tax planning and installment payment purposes. If the executive pay ratio exceeds 1001 then an additional tax will be imposed on apportioned San Francisco gross receipts ranging from 01 to 06 depending on the.

If the proposed tax was. HRGT imposed additional business taxes to create a dedicated fund to support services for homeless people and prevent homelessness including one tax of 0175 to 069. The Commercial Rents GRT is imposed on the gross receipts earned from a lease or sublease in the City at a rate of 35 percent for commercial space and 1 percent for.

The ordinance replaces the existing payroll expense tax on the privilege of doing business in san francisco with a tax that is based on gross receipts from business conducted. The fees range from 15000 to 35000 for companies with payroll expenses over 20M.

Wait How Would Louisiana S Gross Receipts Tax Work Tax Foundation

San Francisco Taxes Filings Due February 28 2022 Pwc

San Francisco Gross Receipts Tax Clarification

Due Dates For San Francisco Gross Receipts Tax

The 2021 Estimated Tax Dilemma What Tax Return Pros Are Doing And Telling Clients

What Happens If You Miss A Quarterly Estimated Tax Payment

Quarterly Tax Calculator Calculate Estimated Taxes

New Sf Tax On Uber And Lyft Will Fund Drivers For Muni

Understanding California S Sales Tax

Stripe Tax Automate Tax Collection On Your Stripe Transactions

California Tax Forms H R Block

State By State Guide Which States Have Gross Receipts Tax Taxvalet Sales Tax Done For You

What Happens If You Miss A Quarterly Estimated Tax Payment

Prop C Would Raise Sf S Gross Receipts Tax Here S What That Means

Current Covid 19 Related Tax Guidance For Oregon Washington And California Kbf Cpas

Estimated Quarterly Tax Payments Blog Seattle Business Apothecary Resource Center For Self Employed Women

![]()

Proposal To Overhaul Business Taxes In Oakland On The Ballot This November